The UK is raising its point-of-consumption (POC) gambling tax from 15 percent to 21 percent. The news came in the form of a recent adjustment to the annual UK Government budget.

Here’s an excerpt from the overview:

If you have a question about your gambling, or the gambling of someone close to you, our FAQs from gambling consumers during lockdown may provide valuable information. Try the new Gambling Commission website we're working on, and give us feedback. Instead, gambling operators must pay taxes, and online gambling site operators must pay UK gambling tax duty. In the United States, the tax rate owed on gambling winnings is a flat 25%. If you win big in Las Vegas at poker, the casino must withhold the 25% when collect your cashout, and provides you with IRS form W2-G to report your winnings to. UK gambling tax applies to casino operators, who are required to pay 2.5-40% of their gross gaming revenue. The United Kingdom has a wide variety of casinos, with around 24 in London, 13 in Scotland and 5 in Wales. There are a total of 139 gambling facilities throughout the country.

“A behavioural adjustment has been made to take into account changes in spending on remote gaming in response to this policy, and to account for changes in operator behaviour.”

The UK expects to generate an extra £1.23 billion ($1.56 billion) from the increase over the next five years.

US states with legalized online gambling — and those looking to regulate the industry — should pay close attention to this change. According to the document, “this measure will impact on individuals or households through a change in odds” if operators pass the tax increase on to players.

- The UK is raising its point-of-consumption (POC) gambling tax from 15 percent to 21 percent.The news came in the form of a recent adjustment to the annual UK Government budget.

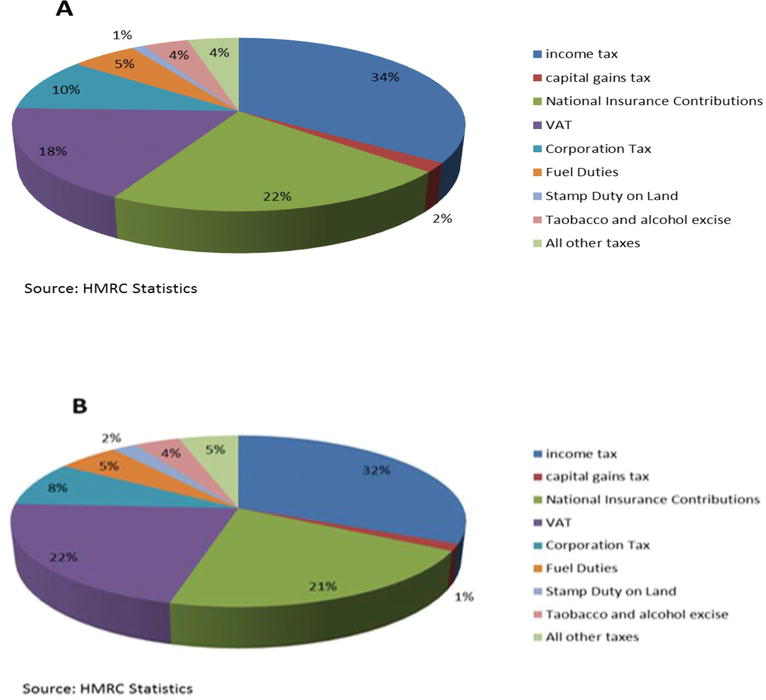

- Her Majesty Revenue and Customs (HMRC) has received an 8% year-on-year decrease in UK betting and gaming tax duty for the current financial year, with income affected by the coronavirus pandemic. HMRC has so far received £1.34bn ($1.74bn) for the financial year from betting and gaming receipts in the country, with 32% coming directly from.

UK has the experience to get tax rates right

The last 10 years have seen the proliferation of gambling regulation in EU member states, which has been accompanied by studies that explore the impact of taxes. They show a clear correlation between tax rates and the proportion of players drawn into the regulated market.

After four years of operation under the POC system, the UK Gambling Commission (UKGC) believes that the overwhelming majority of online poker, sports betting and casino traffic flows through regulated sites.

With an established industry, the UK is now confident it can raise taxes without pushing players into the black market. Some continental peers, by comparison, see as much as 40 percent of their players sticking to offshore, unregulated poker rooms.

Studies also link the amount of gambling revenue directly to the rate, showing that taxes over 20 percent don’t generally result in gains.

Should US states shoot for similar taxes?

In a presentation to two subcommittees of the Illinois legislature, Rep. Lou Lang tackled the issue head-on. “It’s important to do it right, rather than quick,” he said, speaking about sports betting regulation. Otherwise;

“You make a real mess as Pennsylvania did.”

Lang went on to explain that the 36 percent tax on sports betting was a big mistake in Pennsylvania. “If this industry is taxed too high,” he said, “illegal betting continues.”

New Jersey has a tax rate of 17.5 percent for NJ online poker and casinos, while online sports betting is taxed at a rate of 14.25 percent. Both numbers include mandatory additional taxes for redevelopment and other state industries. Nevada has even lower rates of 6.75 percent for both online poker and sports betting.

If the UK has analyzed the situation correctly, both states should have the freedom to raise taxes to a similar level.

New Jersey and Nevada are distinct markets, of course, and what applies to the UK doesn’t necessarily apply to them. But all three markets have followed a similar path. They began with rates well below 20 percent, a sweet spot that attracts players away from the black market. And they already have high rates of channeling to the regulated market.

It’s entirely possible raising tax rates might not drive players back to the offshore sites in these established markets, either.

Raising taxes is easier than reducing them

Pennsylvania faces the opposite problem. It is poised to open interactive gaming with tax rates that are already an impediment to converting offshore players.

Italy offers a correlating example there, having launched its regulated online sports betting industry under an untenable tax. The rates were calculated as a percentage of the total amount wagered, rather than on the revenue operators received. In 2015, the system was changed to a flat rate of 22 percent of gross gaming revenue — a rare example of tax rates being reduced.

The online gaming industry in France has failed to gain support for a similar change, though.

French regulators calculate taxes for poker games as a percentage of each pot — whether or not there’s a flop. This has resulted in online poker operators paying the equivalent of 37 percent of their gross gaming revenue.

Sure enough, online poker began to decline soon after it was first regulated in France. Revenues have increased only in the period since shared liquidity linked France and Spain.

What’s the bottom line?

In short, there are three European lessons to follow for Pennsylvania and other states that want to get gambling tax and regulation right:

- Start with tax rates that will channel the highest percentage of the market to regulated sites.

- Don’t increase taxes until the market is stable.

- Don’t increase taxes much above 20 percent.

Most Liked Casino Bonuses in the last 7 days 🍒

$ 80 No Deposit Bonus at Grand Fortune Casino

80 Free Spins at Lucky Creek Casino

$ 90 No Deposit Bonus at Club Player Casino

- B6655644

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 30 xB

- Max cash out:

- $ 1000

Tax on Betting & Gambling – Do I Need to pay tax?. in a move designed by the government to increase tax revenue from online operators based off shore.

Enjoy!

This report provides a comprehensive summary of the regulatory regime for sports betting in New Hampshire, including information from the operating agreement between the NH Lottery and DraftKings.

Latest monthly Lottery and Betting Tax Report data from the Bundesministerium der Finanzen German Federal Ministry of Finance.

The data uk gambling tax revenue 2020 for the country contains the following information.

Specific time slots for gambling advertising are currently being discussed at the Romanian parliament.

Additional player protection measures are also under consideration.

Dutch online gambling legislation, if it ever takes effect, could be the strictest in the world on fighting gambling addiction, according to a regulator and a former regulator.

In September 2016, Colombia became the first country in Latin America to establish a grand firelake casino fireworks 2020 licensing regime for online gaming.

The Colombian gaming authority, Coljuegos, has awarded 18 concession.

The European Commission has opened two investigations to determine whether Germany breached EU state aid rules by uk gambling tax revenue 2020 special tax treatment to public casino operators.

Online gaming and sports betting will soon be legal in Michigan after the legislature sent a package of bills to Governor Gretchen Whitmer on Wednesday.

- TT6335644

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 60 xB

- Max cash out:

- $ 1000

austerity drive, receipts have recovered, and by 2020 will be 37.2% of.. Figure 2 shows the breakdown of UK tax revenues in 2015–16. The UK. taxes' includes alcohol duties, tobacco duties, betting and gaming duties, air passenger duty,.

Enjoy!

- BN55TO644

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 50 xB

- Max cash out:

- $ 1000

GGB's annual sneak peek at the things likely to impact gaming in 2020.. Other research from the U.K. shows that mobile wagering, allowing for.. to destroy the illegal casinos and to create more tax revenues for the state.

Enjoy!

- A7684562

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 60 xB

- Max cash out:

- $ 200

Gambling Winnings Tax In The UK Abolished This tax shrunk to 6.75% over time, before being completely abolished in March 2001 by the then-Chancellor of the Exchequer Gordon Brown. This change fully came into effect on the first day of the following year, January 1st, 2002.

Enjoy!

- A67444455

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 60 xB

- Max cash out:

- $ 1000

Gambling taxes - Remote Gaming Duty increase. 2018 to 2019, 2019 to 2020, 2020 to 2021, 2021 to 2022, 2022 to 2023 ...

Enjoy! Valid for casinos

Currently, the POC tax rate stands at 15 percent for online https://pink-stuf.com/2020/daftar-poker-online-terpercaya-2020.html />This movement is seen, in part, as a way to placate the critics who are still angry that the cut to maximum stakes on fixed-odds betting terminals is not going to happen until 2020.

Point-of-Consumption Taxes Point-of-consumption taxes were first introduced in the United Kingdom in 2014 when the British government instituted it as a way to tax British citizens for continue reading that might not be based in the area but receive revenue from the area.

These businesses would include casino websites and sportsbooks websites that do business in the U.

British companies sometimes choose to do business off-island in order to keep their operating costs low and to pay lower taxes on their uk gambling tax revenue 2020 />Despite the backlash, POC taxes are in the process of being implemented or have already been implemented in.

The British government has been criticized for the timing of the POC increase.

Critics have complained that the only reason the United Kingdom has raised the POC taxes is because the Treasury was worried a loss in revenue would affect the budget, and its research indicated that lowering the betting limits on Uk gambling tax revenue 2020 machines meant lower revenue.

There is no timeline for either the POC tax increase or the FOBT decrease.

The Treasury has stated it will to try to implement the POC uk gambling tax revenue 2020 increase by the spring of 2019 and it wants to move the FOBT decrease to April 2020.

This would have a chilling effect on the gaming industry, as well as the unemployment rate and the British economy.

Gaming companies have said the increases in taxes and decreases in revenue have the potential to greatly disrupt their businesses.

Whatever the British government decides to do, it is possible that gaming establishments will uk gambling tax revenue 2020 the costs of operation, uk gambling tax revenue 2020 would include taxes, down to their customers.

One way that the cost might be passed down is in the form of a consumer tax on cash payouts.

This consumer tax on online cash payouts is already in effect in France and Spain because of their higher tax rates on gaming institutions, which went into effect several years ago.

Disclaimer: All images are copyright to their respective owners and are used by USA Online Casino for informational purposes only.

Angeline Everett: A Massachusetts native, blogger Angeline Everett grew up in the Allston neighborhood of Boston and earned a degree in casino management from the University of Massachusetts-Amherst.

After graduating, Angeline moved to Atlantic City where she joined the young team at the Borgata Casino as a compliance representative, while blogging on the side.

After a few years in the back office, Angeline moved to uk gambling tax revenue 2020 floor to work first at a casual poker dealer and later casual poker floor supervisor.

Fascinated with games of chance since she was a child, Angeline currently divides her time between blogging and work on her first book.

- A7684562

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 30 xB

- Max cash out:

- $ 200

Saracen Casino Resort in Arkansas on track for June 2020 opening. 01/03/2020 · Legislation Tax proceeds would be allocated for public education. Connecticut gambling revenue drops following increased Massachusetts competition. UK casino operators could be subject to Financial Conduct Authority's supervision ...

Enjoy!

- A67444455

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 30 xB

- Max cash out:

- $ 1000

Gambling in the United Kingdom is regulated by the Gambling Commission on behalf of the.. 28% of lottery revenue goes towards the fund, along with all unclaimed prizes. Additionally, 12%. is commutative. This tax was abolished with the general reform of the gambling acts... Casino.Buzz. Retrieved 5 January 2020.

Enjoy!

- JK644W564

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 60 xB

- Max cash out:

- $ 1000

Tax year 2019 to 2020. Percentage of 'net stake receipts' (essentially the gross profits from bookmaking) for fixed odds bets and totalisator on ...

Enjoy!

Uk Gambling Tax Revenue Reporting

- B6655644

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 60 xB

- Max cash out:

- $ 1000

EXHIBIT 1.2: SOUTHERN NEW ENGLAND GAMING REVENUES BY.. EXHIBIT 1.17: SUMMARY OF RHODE ISLAND GOVERNMENT REVENUE BY FISCAL YEAR ... January and June of 2020, respectively..... IGT (and their sports wagering partner U.K. based William Hill), submitted a final bid.

Enjoy!

Gambling Tax Laws

CommentsEarlier this read article, the government approved plans to establish a gambling regulatory authority in Ireland.The new gambling authority would be given the power to develop and enforce necessary and appropriate licencing and regulatory measures in respect of all gambling activities, including online betting.

In lieu of that authority yet being in place, the gambling industry has lobbied consistently over the past year for the recent increase in betting duty to be reversed.

Gambling tax The way that the government uk gambling tax revenue 2020 the betting industry is on turnover — so that companies see more tax on every euro a person stakes in a bet.

In Budget 2019, Minister Donohoe raised gambling duty from 1% of turnover to 2%.

This was met with dismay uk gambling tax revenue 2020 the gambling industry, which warned that bookies — particularly those based in rural areas — would go out of business as a result.

In the wake of Budget 2019, Paddy Power Betfair chairman Gary McGann requested an urgent meeting with the minister to discuss the tax increase.

Donohoe said he had sympathy for small bookmakers who may have ongoing problems competing with large retail and online bookmakers.

It said that 35 shops across the country uk gambling tax revenue 2020 closed as a result of the betting duty increase that came into effect on 1 January.

The IBA — which represents over 700 shops in Ireland — claims it will ultimately result in thousands of job losses across rural Ireland.

The minister had previously indicated he would look at the proposals put forth by the betting industry.

In response to a parliamentary question last week, Donohoe indicated that his officials had discussed the matter at European level before coming to its decision.

The key element of the proposal was the source rates for the retail and online uk gambling tax revenue 2020 and my Department does not see any compelling case to change from the current model to a gross profits model at this point in time.

This site uses cookies.

By continuing to browse, you agree to the use of cookies.

You can change your settings or.

- CODE5637

- Bonus:

- Free Spins

- Players:

- All

- WR:

- 60 xB

- Max cash out:

- $ 500

The Future of UK Gaming - Online Casino Trends for 2020.. the attraction government has had to ever increasing tax revenue from remote gambling is going to ...

Enjoy!